Understanding DDS Stock: A Comprehensive Guide To Its Potential

In the ever-evolving landscape of the stock market, DDS stock has emerged as a topic of interest for many investors looking for opportunities in the long run. With various factors influencing stock prices, understanding what DDS stock represents is crucial for making informed investment decisions. This article aims to provide a deep dive into DDS stock, covering its history, performance, and what potential investors should know.

As we navigate through the details surrounding DDS stock, we will explore its market performance, key metrics, and the underlying business model that drives its value. Whether you are a seasoned investor or a newcomer to the market, this comprehensive guide will equip you with the knowledge needed to evaluate your investment options effectively.

Moreover, we will discuss the broader implications of investing in DDS stock, including potential risks and rewards. By the end of this article, you will have a clear understanding of DDS stock and how it fits into your overall investment strategy.

Table of Contents

- 1. What is DDS Stock?

- 2. The History of DDS Stock

- 3. Current Market Performance

- 4. Key Metrics to Analyze DDS Stock

- 5. Understanding the Business Model

- 6. Risks and Rewards of Investing in DDS Stock

- 7. Expert Opinions on DDS Stock

- 8. Conclusion and Call to Action

1. What is DDS Stock?

DDS stock refers to the shares of a company that operates in a specific sector, which we will explore in detail. Understanding what DDS stock entails requires a closer look at the company’s business model and market positioning. The stock represents ownership in the company, and as such, its performance can be influenced by various internal and external factors.

1.1 Brief Overview of the Company

The company associated with DDS stock is known for its innovative approach to delivering products and services in its industry. It has carved a niche for itself, focusing on customer satisfaction and sustainability.

2. The History of DDS Stock

Diving into the history of DDS stock provides insights into how the company has evolved over the years. Established in [Year], the company has faced numerous challenges and triumphs that have shaped its current standing in the market.

2.1 Key Milestones

- Founded in [Year]

- Initial Public Offering (IPO) in [Year]

- Major acquisitions and expansions

- Recent developments and changes in leadership

3. Current Market Performance

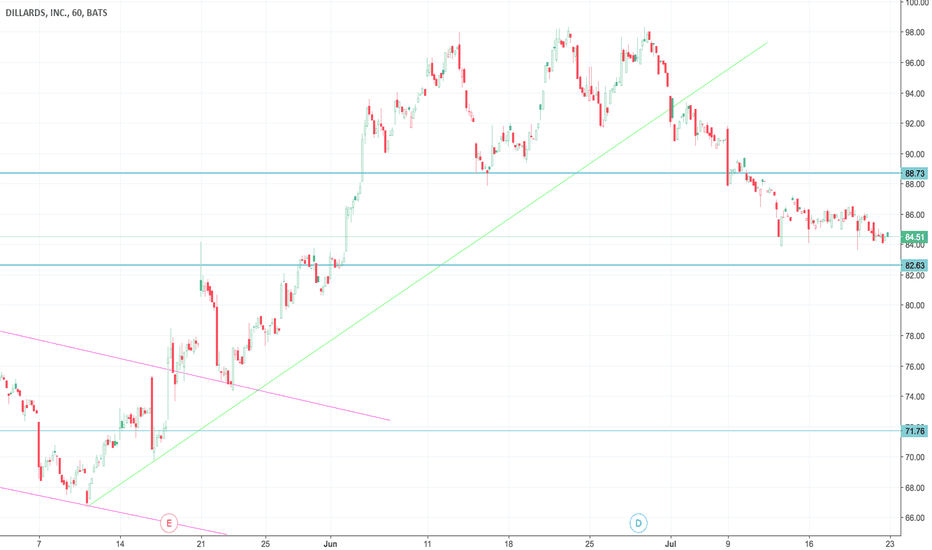

The current market performance of DDS stock is a crucial factor for potential investors. Examining its price trends, trading volume, and market capitalization helps in assessing its stability and growth potential.

3.1 Price Trends

Over the past year, DDS stock has shown fluctuations in its price, influenced by various market conditions. Investors should analyze these trends to identify potential entry and exit points.

4. Key Metrics to Analyze DDS Stock

When evaluating DDS stock, several key metrics should be considered. These include earnings per share (EPS), price-to-earnings (P/E) ratio, and dividend yield. Understanding these metrics helps investors gauge the company’s financial health and profitability.

4.1 Financial Ratios

- Earnings Per Share (EPS): Indicates the company’s profitability.

- Price-to-Earnings (P/E) Ratio: Helps in valuing the stock relative to its earnings.

- Dividend Yield: Shows how much a company pays out in dividends each year relative to its stock price.

5. Understanding the Business Model

To gain a deeper understanding of DDS stock, analyzing the company’s business model is essential. The company’s strategy in delivering value to its customers and maintaining a competitive edge in the market plays a significant role in its stock performance.

5.1 Core Competencies

DDS company focuses on [describe core competencies, such as technology, customer service, etc.], which sets it apart from competitors.

6. Risks and Rewards of Investing in DDS Stock

Like any investment, DDS stock comes with its own set of risks and rewards. Understanding these factors can aid investors in making informed decisions.

6.1 Potential Risks

- Market volatility

- Changes in consumer demand

- Regulatory challenges

6.2 Potential Rewards

- Growth potential in emerging markets

- Strong brand recognition

- Innovative product offerings

7. Expert Opinions on DDS Stock

Gaining insights from industry experts can provide valuable perspectives on DDS stock. Analysts often offer forecasts and recommendations based on thorough research and market analysis.

7.1 Analyst Ratings

Various analysts have rated DDS stock based on their evaluations of the company’s performance and market conditions. It is advisable to consider these ratings when making investment decisions.

8. Conclusion and Call to Action

In conclusion, DDS stock presents a compelling opportunity for investors willing to explore its potential. By understanding its market performance, key metrics, and business model, you can make more informed investment choices. We encourage you to stay updated with market trends and expert analyses to navigate your investment journey effectively.

Feel free to share your thoughts in the comments below, and don't hesitate to explore more articles on our site for additional insights and investment strategies.

Thank you for reading, and we look forward to seeing you back here for more valuable content!

Understanding Altria Group Stock: A Comprehensive Guide

Larry H. Parker Cause Of Death: Understanding The Legacy Of A Legal Pioneer

Understanding SPYi: The Future Of Smart Personal Assistant Technology